Table of Contents

The Problem That Started It All

Imagine you bought a cup of coffee with Bitcoin six months ago. Back then, it cost you 0.0001 BTC. Today, that same amount of Bitcoin could buy you either half a cup or three cups, depending on Bitcoin’s wild price swings. But if you paid with dollars six months ago and pay with dollars today, you’d pay roughly the same amount. This is the fundamental problem that stablecoins solve.

What Are Stablecoins?

Most people think stablecoins are simply “non-volatile crypto assets.” This definition is wrong.

The correct definition: A stablecoin is a crypto asset whose buying power fluctuates very little relative to the rest of the market.

The keyword here is “buying power.” It’s not about price stability, it’s about purchasing power stability. A stablecoin should let you buy roughly the same amount of goods today as you could yesterday, next week, or next month.

Why Do We Care About Stablecoins?

Money serves three critical functions, and understanding these explains why stablecoins matter:

1. Store of Value

Money should preserve your wealth over time. When you save money in a bank or invest in stocks, you expect it to maintain its purchasing power. Volatile assets like Bitcoin fail at this because your wealth can disappear overnight.

2. Unit of Account

Money should help us measure how valuable something is. We price Bitcoin in dollars, not the other way around, because Bitcoin’s constant price changes make it a poor measuring stick. Nobody wants to price their business in Bitcoin when it could be worth 50% less tomorrow.

3. Medium of Exchange

Money should facilitate transactions. While you can technically buy groceries with Bitcoin, most people won’t because they don’t want to spend an asset that might double in value next week.

The Web3 Money Problem: Ethereum works great as a store of value and medium of exchange, but fails as a unit of account due to its volatile nature. We need Web3 money that can do all three functions reliably

Categories and Properties of Stablecoins

1. Relative Stability: Pegged/Anchored or Floating

Pegged Stablecoins: These are tied to another asset’s value. Most popular stablecoins fall into this category:

- Tether (USDT): 1 USDT = 1 USD

- USD Coin (USDC): 1 USDC = 1 USD

Floating Stablecoins: These maintain stable buying power without being tied to any specific asset. Think of it this way: if you could buy 10 apples with 10 dollars five years ago, but today you can only buy 5 apples with 10 dollars due to inflation, a floating stablecoin would adjust so you can still buy 10 apples with the same amount.

Anchored Stablecoins: These are pegged to a specific reference point that moves over time. Think of it like measuring ocean levels, where the anchor point itself changes but the relationship remains stable.

2. Stability Method: Governed vs Algorithmic

This refers to who or what controls the minting and burning of stablecoins to maintain their peg.

Governed Stablecoins: Humans or organizations decide when to create or destroy tokens. These are typically centralized:

- A government entity

- A company (like Circle for USDC)

- A decentralized autonomous organization (DAO)

Algorithmic Stablecoins: Smart contracts automatically mint and burn tokens based on predetermined rules. No human intervention required:

- DAI (partially algorithmic)

- FRAX

- RAI

- UST (failed example)

3. Collateral Type: Endogenous vs Exogenous

This describes what backs the stablecoin’s value.

Exogenous Collateral: Backed by assets outside the stablecoin’s ecosystem:

- USDC is backed by US dollars

- DAI is backed by ETH, USDC, and other external assets

If these stablecoins fail, their underlying collateral (dollars, ETH) continues to exist and function.

Endogenous Collateral: Backed by assets within the same ecosystem:

- UST was backed by LUNA tokens

- If UST failed, LUNA would fail too (which actually happened)

The relationship creates a reflexive loop where the stablecoin and its collateral depend on each other for value.

The Endogenous Dilemma

Endogenous collateral sounds risky, so why use it at all?

The Answer: Capital Efficiency

With exogenous stablecoins like USDC, you need to over-collateralize. To mint $100 worth of DAI, you might need to deposit $150 worth of ETH. This ties up a lot of capital.

Endogenous stablecoins can theoretically operate with zero external collateral because they’re backed by their own ecosystem. This makes them highly capital efficient but also highly risky.

Summary of Popular Stablecoins

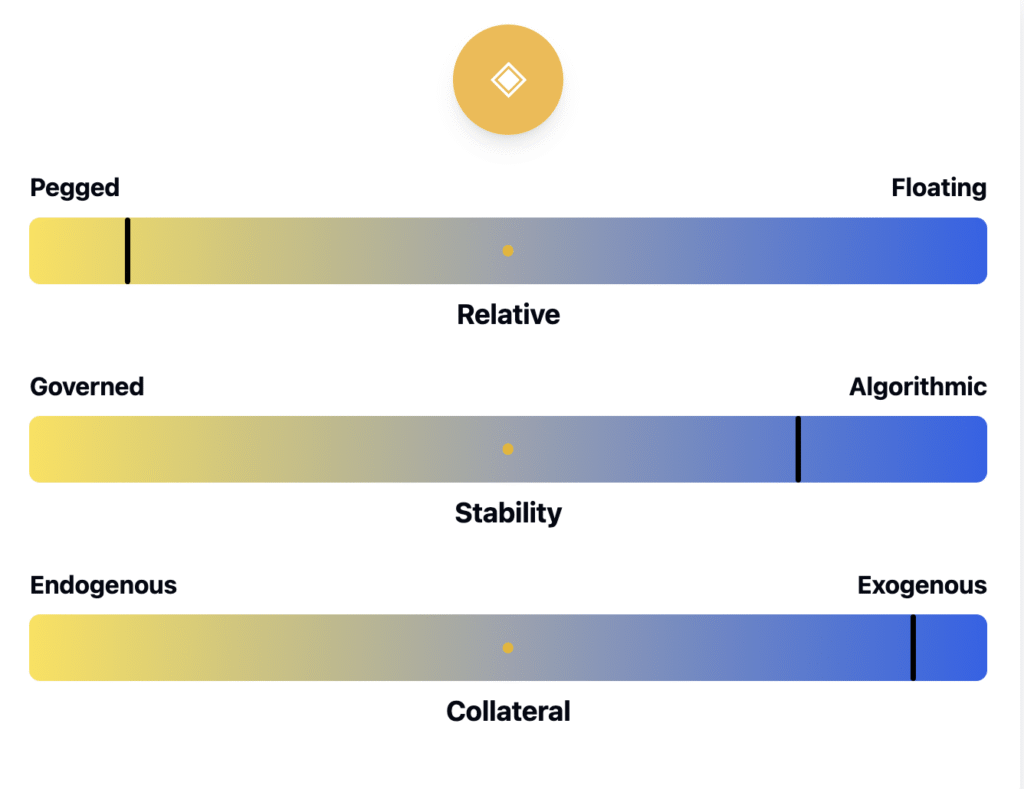

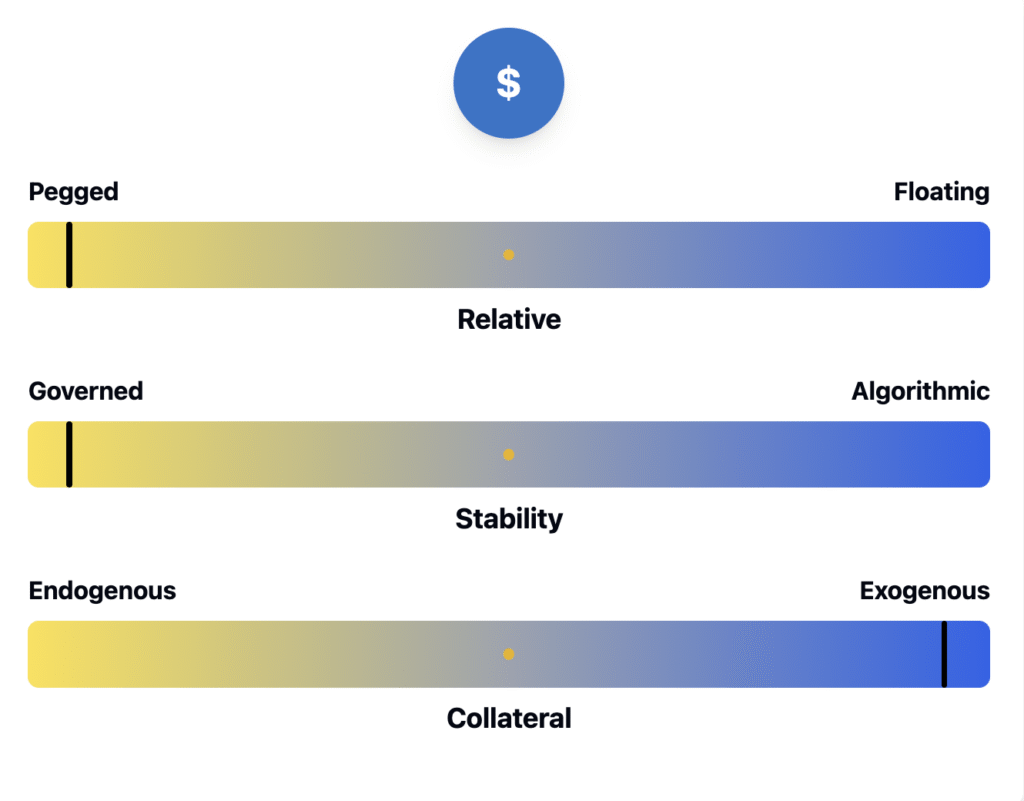

Check out these visuals to understand how some of the most well-known stablecoins are built and how they work

(DAI StableCoin)

( USDC StableCoin)

(RAI StableCoin)

What Stablecoins Really Do

Beyond just maintaining stable value, stablecoins serve as:

Financial Infrastructure: They enable DeFi protocols to function with predictable unit pricing.

Bridge Between Traditional and Crypto: They allow seamless movement between fiat and crypto worlds.

Yield Generation: Many stablecoins can be staked or lent to earn interest.

Global Access: They provide dollar-equivalent access to people in countries with unstable currencies.

Which Stablecoins Are Good?

For Safety and Reliability:

- USDC: Highly regulated, transparent reserves

- DAI: Decentralized, over-collateralized, battle-tested

For Innovation:

- RAI: Truly algorithmic, not pegged to fiat

- FRAX: Hybrid model balancing efficiency and stability

Trade-offs to Consider:

- Centralized stablecoins (USDC) offer stability but can be frozen or regulated

- Decentralized stablecoins (DAI, RAI) offer censorship resistance but may have slight fees and complexity

- Algorithmic stablecoins offer capital efficiency but carry higher risks

The Future of Stablecoins

The stablecoin landscape continues evolving as projects balance three competing priorities:

- Stability – Maintaining purchasing power

- Decentralization – Avoiding central points of failure

- Capital Efficiency – Maximizing utility of locked assets

The most successful stablecoins will likely be those that find the optimal balance between these three factors while serving the core functions of money in the digital age.

Before you use or build with stablecoins, take the time to understand how they’re designed. The more you know, the better decisions you’ll make in the Web3 world.

Leave a Reply